The U.S. Department of Commerce and GlobalFoundries agree to provide $1.5 billion in direct funding under the CHIPS and Science Act to help bolster domestic semiconductor production.

As the U.S. works to strengthen its supply chain resilience and bolster domestic semiconductor production, Uncle Sam appears to be onboard with the idea and willing to fund and support at least some of the activity. Earlier this month the U.S. Department of Commerce and GlobalFoundries (GF) signed a non-binding preliminary memorandum of terms (PMT) to provide approximately $1.5 billion in direct funding under the CHIPS and Science Act to strengthen U.S. domestic supply chain resilience.

The funding will also go to bolster U.S. competitiveness in current-generation and mature-node (C&M) semiconductor production and support economic and national security capabilities. According to a Department of Commerce press release, the funding will be used to build a new state-of-the-art facility and significantly expand and modernize GlobalFoundries’ manufacturing sites in New York and Vermont, where automotive, communications and defense semiconductor technologies are produced.

Where the Money Will Go

The approximately $1.5 billion in CHIPS funding will be split across these three projects:

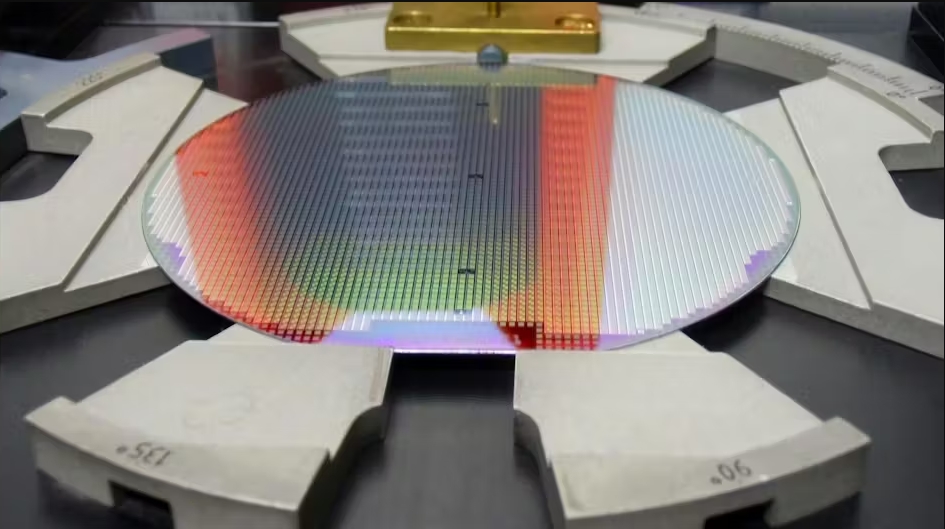

- Malta, N.Y. – New State-of-the-Art 300 mm Fab: The construction of a new, large-scale 300 mm fabrication facility that is expected to produce high value technologies not currently available in the U.S. The new facility is intended to leverage existing infrastructure to expedite the path from construction to production.

- Malta, N.Y. – Capacity Expansion for Automotive: The proposed expansion of the existing Malta fabrication facility, which includes a strategic agreement with General Motors, to secure a dedicated supply of essential semiconductor technologies.

- Burlington, Vt. – Fab Revitalization: The revitalization of an existing fabrication facility in Burlington to commercialize new 200 mm technologies, creating the first U.S. facility capable of high-volume manufacturing of next-generation Gallium Nitride on Silicon for use in electric vehicles, power grids, 5G and 6G smartphones, and other critical technologies.

Combined, the three proposed projects would create approximately 1,500 manufacturing jobs and approximately 9,000 construction jobs over the next 10 years. “GF chips are fundamental to everyday applications that impact all Americans, from blind spot detection and collision warnings in cars, to smartphones and electric vehicles that last longer between charges, to secure and reliable Wi-Fi and cellular connections,” the Department of Commerce says. There are currently only four companies outside of China that provide current and mature foundry capabilities at the scale of GF, it adds.

“Semiconductors are in everything from our cellphones, to refrigerators, to cars, and our most advanced weapons systems, and access to them carries important economic and national security implications,” Secretary of Commerce Gina Raimondo said in the press release. “It was the shortages of semiconductors during the COVID-19 pandemic that raised prices for consumers and led to the shutdown of automobile manufacturing sites across the country.”

Reversing the Decline

This new $1.5 billion grant is the third one that falls under the CHIPS and Science Act, a $52 billion program President Biden signed in 2022 in hopes of supercharging U.S. manufacturing of semiconductors, which are largely made overseas, according to the Washington Post. It says the “decades-long decline” in U.S. chip manufacturing, as companies pursued lower costs overseas, has fueled concern in Washington over the nation’s supply chain for the tiny electrical components that form the bedrock of modern life.

“The United States pioneered the technology decades ago but has since lagged in the production of both kinds of chips, even as China’s capabilities have soared,” the publication adds. “Although U.S.-based plants made 37 percent of the world’s chips in 1990, their share of production has slid to about 12 percent.”