After getting on the path to recovery in 2023, the semiconductor sector is now poised for a rebound in 2024.

This was a busy year for the global semiconductor market, and the fourth quarter brought with it some new developments. In December, Samsung Electronics announced that it was building a new, $280 million facility in Japan. According to Reuters, the facility will be used for research into advanced chip packaging.

Japan’s industry ministry will provide Samsung subsidies as it looks to “support the revitalization of domestic chip manufacturing,” Reuters reports. “Samsung’s investment comes at a time of easing tensions between South Korea and Japan as the United States encourages allies to work together to counter China’s growing technological prowess.”

Samsung has been putting more emphasis on advanced chip packaging since 2022, and is one of several companies that are “racing to develop advanced packaging techniques, which involve combining components in a single package to improve overall chip performance,” the publication adds.

Chips that Support Green Auto Production

As the automotive industry continues to evolve and build more eco-friendly engine options, the sector needs more semiconductors than ever. In “The Use of Semiconductors in Automotive Manufacturing,” Ibtisam Abbasi details how the automotive sector’s push for more reliable, efficient and safe cars has driven a “major boost” in the use of semiconductors in vehicles.

“The number of semiconductor chips in a modern car varies with the type; however, one can expect the number in the range of 1000 – 3500,” Abbasi writes. “New types of sensors, such as enhanced lidars and smart cameras, are being incorporated into newer cars. These sensors are based on advanced semiconductor chips, which ensure maximum efficiency.”

Chips also play in an important role in the modern Engine Control Units (ECUs), each of which performs a specific task—mostly regulating various essential engine performance parameters.

“The semiconductors in vehicles are used for the analysis of engine temperature and pressure sensor data, adjusting the fuel injection for optimum combustion, optimization of ignition timing, as well as managing emissions,” Abbasi points out. “In short, the semiconductors in vehicles are essential for improved fuel efficiency and reducing greenhouse gas emissions.”

Foreign Talent Needed

The Creating Helpful Incentives to Produce Semiconductors for America Act (CHIPS Act) provides substantial investments in semiconductor research, development and manufacturing capabilities within the United States, fostering innovation and job creation. It also creates a new need for talent that can build, engineer, design and manage the advanced technologies, devices and components.

According to labor and law firm Jackson Lewis, the highly competitive and rapidly evolving technology industry requires top talent with expertise in STEM (science, technology, engineering and mathematics) fields. As such, foreign national talent, combined with the availability of various U.S. visas, will play a crucial role in supporting the goals of the CHIPS Act.

According to the Semiconductor Industry Association (SIA), the industry will have to fill 115,000 jobs by 2030 to meet the goals outlined in the CHIPS Act. “Early research has indicated there are simply not enough U.S. students in the pipeline,” Jackson Lewis points out. “Therefore, many companies likely will need to turn to foreign nationals and recruit and retain international students to bridge the hiring gap.”

A New Wave of Growth

In 2024, IDC expects the semiconductor market to continue on its road to recovery and post an annual growth rate of 20%. Global demand for artificial intelligence (AI) and high-performance computing (HPC)—coupled with the “stabilizing demand for smartphones, personal computers, infrastructure, and resilient growth in automotive”—will help usher in a new wave of growth for the semiconductor industry, IDC adds.

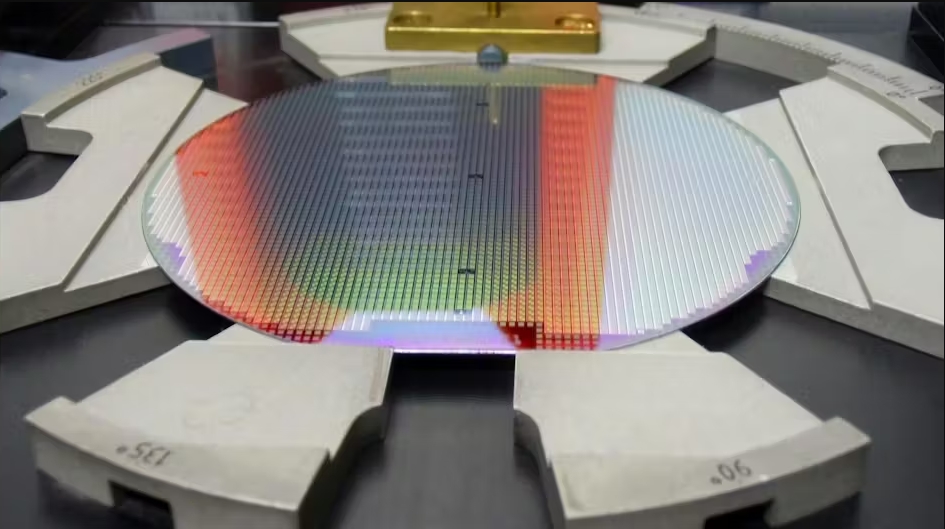

“Memory manufacturers’ strict control of supply and output has led to increasing prices from the start of November, and the demand for AI across all major applications will drive the overall semiconductor sales market to recover in 2024,” IDC’s Galen Zeng says. “The semiconductor supply chain, including design, manufacturing, packaging, and testing, will bid farewell to the downturn in 2023.”